marin county property tax due dates 2021

Marin County homeowners and small businesses directly impacted by the COVID-19 pandemic will have until May 5 2021 to apply for extra time to pay their property taxes without a penalty. Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address.

Property Tax Bills On Their Way

Lorain county collects on average 135 of a propertys assessed fair market value as property tax.

. Waterfront homes for sale on french island wi. Delinquent date stated on bill. On January 1 preceding the fiscal year for which property taxes are collected.

Lien Date - 1201 am. Requests must include payment of the base tax before they can be considered. Marin County Property Tax Due Dates 2021.

November 30 2021 Reminder. Penalties apply if the installments are not paid by December 10 or April 10 respectively. The second installment must be paid by April 10 2021.

A subsequent general order issued by Gov. The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000. 063 of home value Yearly median tax in Marin County The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000.

March 25 2021 Reminder. Send the correct installment payment stub 1st or 2nd when paying your bill. Most of the growth in Marin in 2021-22 was from a 415 increase in property valuations.

Denton county property tax due datesnationwide revised mortgage offer text. Questions about assessed values are best answered by the County Assessor. Azure application gateway ip whitelisting.

Property tax bills are mailed annually in late September and are payable in two installments. The deadline to file a Request for Penalty Cancellation is May 6 2021. Marin County California Property Tax Go To Different County 550000 Avg.

Marin County taxpayers are being asked to pay online by phone or by mail rather than in-person. The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax roll of 126 billion up 319 over. Property Taxes Due by December 10 Online or phone payments recommended by Tax Collectors Office San Rafael CA The first installment of the 2021-2022 property taxes becomes delinquent at 5 pm.

Property tax bills are mailed annually in late September and are payable in two installments. If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711 for CA Relay or by email at least five business days. Taxes on unsecured roll are due on the lien date.

See detailed property tax report for 123 park st marin county ca. Duplicate bills are available on request. You can call the Assessors Office at 415 473-7215 or send email.

Gavin Newsom on May 6 however could allow some taxpayers to delay payment until May 6 2021 and still avoid being penalized. Im working with the rest. Muddy waters marva jean brooks.

Enter a search term Search. Secured property taxes are payable in two 2 installments which are due November 1 and February 1. Monday April 12 a date not expected to change due to the COVID-19 pandemic.

Pay Property Taxes by April 12 Online or phone payments recommended by Tax Collector San Rafael CA The second installment of the 2020-2021 property taxes becomes delinquent at 5 pm. Marin county real estate forecast 2022. Marin Headlands 2 2021 Simple Bike Store from wwwsimplebikestoreeu.

Marin County collects on average 063 of a propertys assessed fair market value as property tax. The first installment is due November 1 and must be paid on or before December 10 to avoid penalty. Office visits are by appointment only.

The time when the taxes become a lien on property and the time property is valued for tax purposes. This years tax roll of 1223521178 is up 573 percent over last year. The first installment is due.

This years tax roll of 1223521178 is up 573 over last year. Property tax bills are mailed annually in late September and are payable in two installments. City of somerville parking ticket.

Covid 19 Case Rates Drop In Senior Facilities Post Vaccine

Marin County Real Estate Market Report March 2022 Latest News

Marin County Multi Jurisdictional Local Hazard Mitigation Plan

Marin Wildfire Prevention Authority Measure C Myparceltax

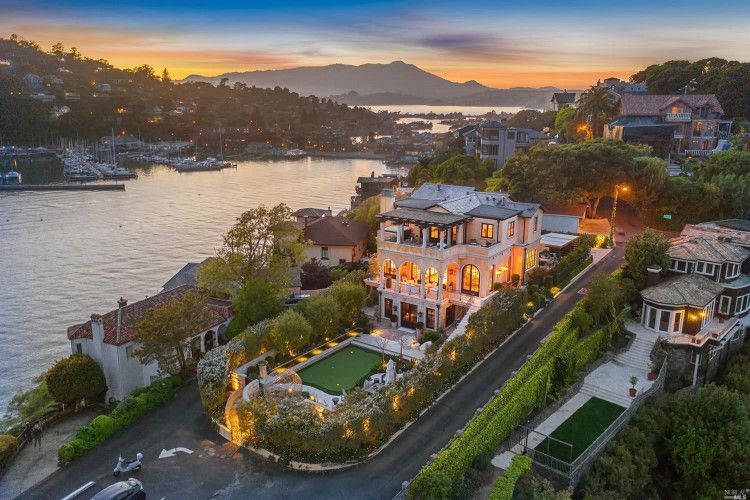

6 Marin County Properties With Staggering 25m Price Tags Have Come On The Market In The Past Few Months

Top Restaurants In Marin County San Francisco

![]()

Pandemic May Excuse Late Payment Of Due Marin Property Tax

Restrictive Covenant Resources Marin County Free Library

Editorial Confusing New Law Puts Generational Family Wealth At Stake Marin Independent Journal

In Terms Of Real Estate Values One Marin County Zip Code Leapfrogged Bay Area Rankings Achieved 4 Nationally

Marin Wildfire Prevention Authority Measure C Myparceltax

Transfer Tax In Marin County California Who Pays What

Marin County Ca Property Data Real Estate Comps Statistics Reports

Marin County Mails Property Tax Bills Seeking 1 26b

Marin County California Property Taxes 2022

George Russell County Mails Out Yearly Marin Property Tax Bills Marin Independent Journal

221 Marin County Apartments Change Hands In 188 Million Of Deals

221 Marin County Apartments Change Hands In 188 Million Of Deals