nevada estate tax rate

It is one of the 38 states that does not apply an estate tax. Under Nevada law there are no inheritance or estate taxes.

Nevada Tax Rates And Benefits Living In Nevada Saves Money

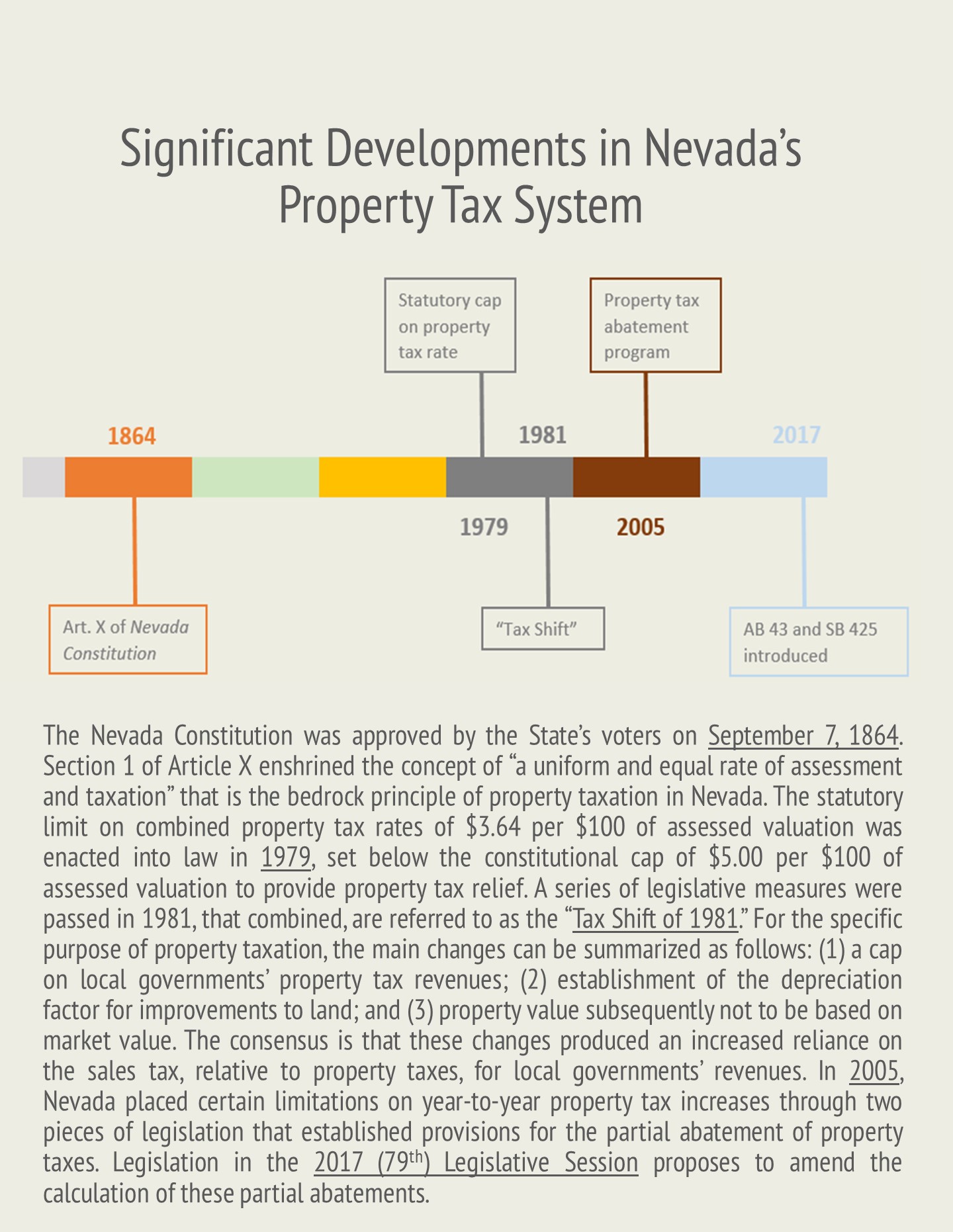

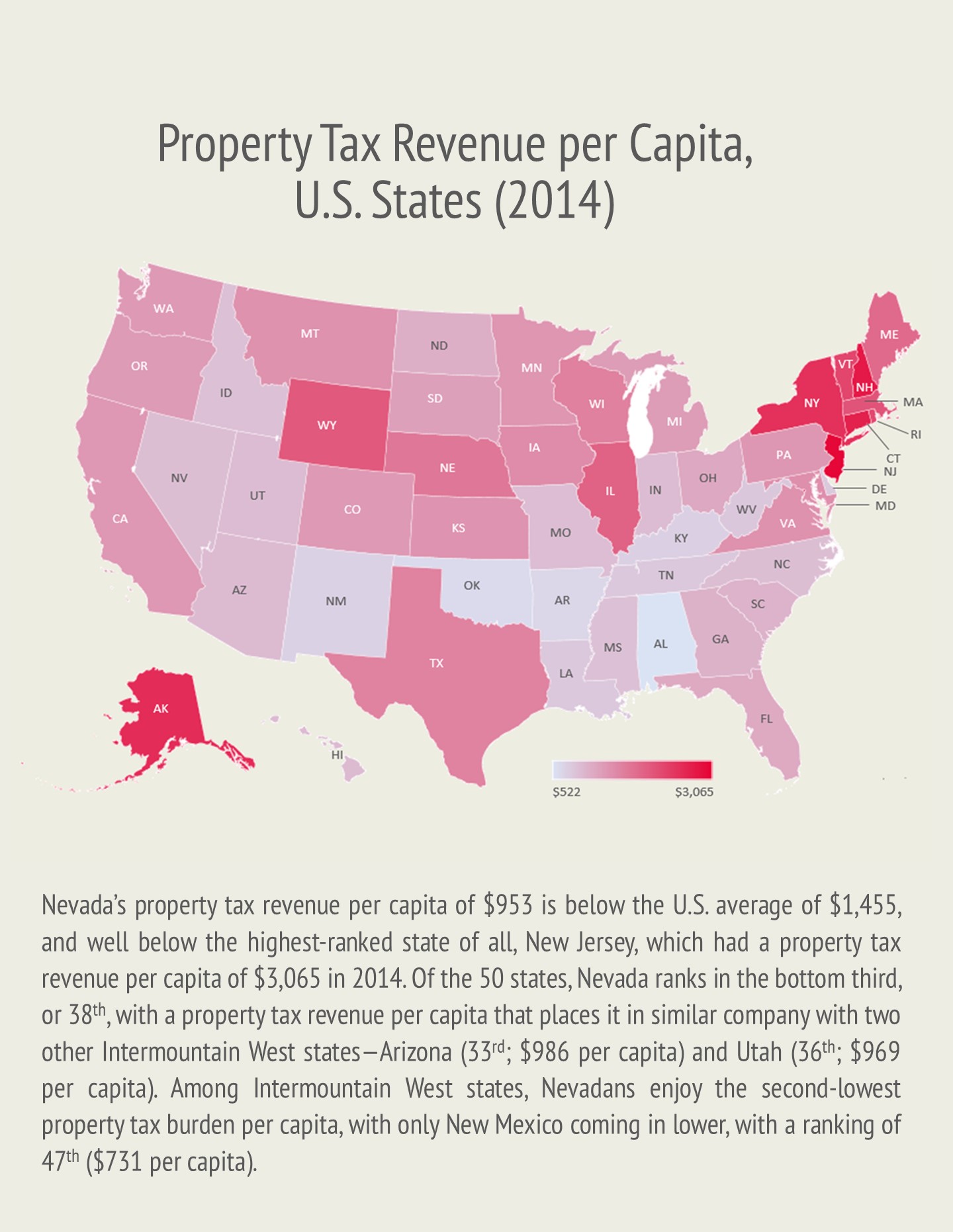

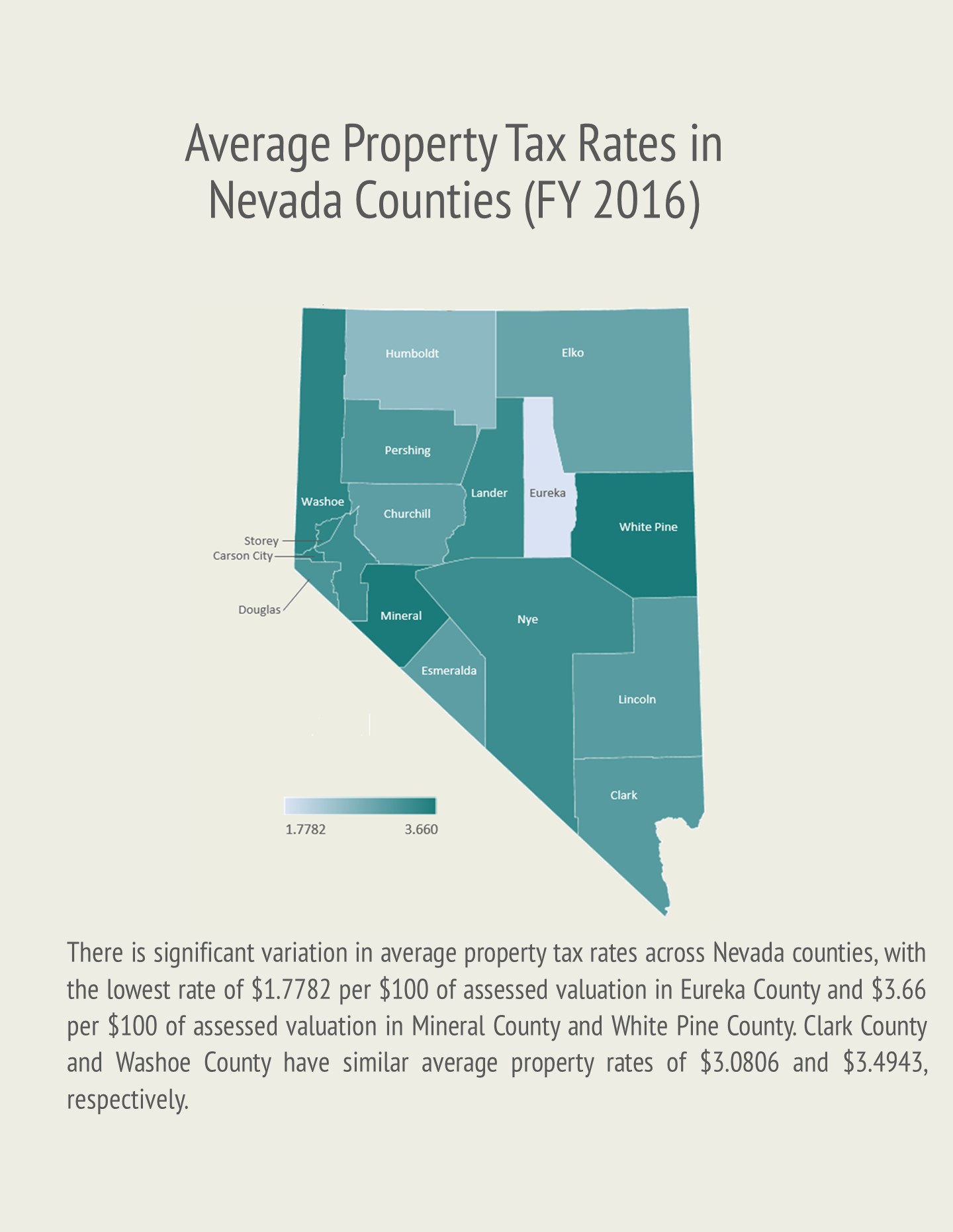

However the property tax rates in Nevada are some of the lowest in the US.

. 31 rows The latest sales tax rates for cities in Nevada NV state. The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. Nevada repealed its estate tax also called a pick-up.

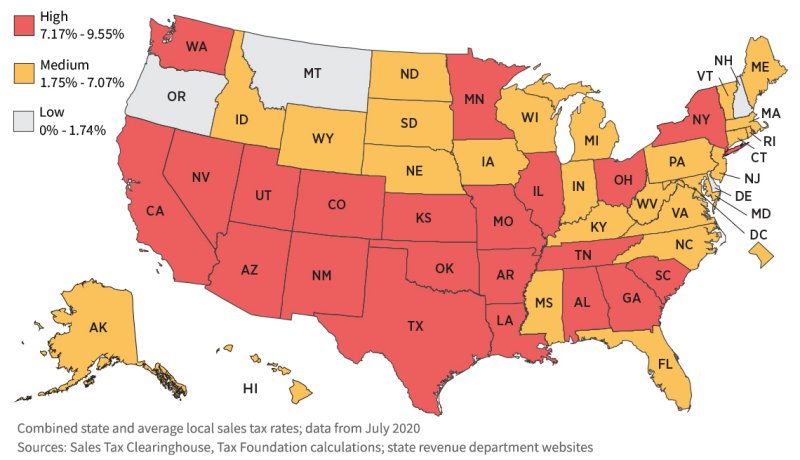

Nevada is one of seven states that do not collect a personal income tax. But Nevada does have a relatively high sales tax a state rate is around 7 but goes to approximately 8 when you consider local tax rates. 2020 rates included for use while preparing your income tax.

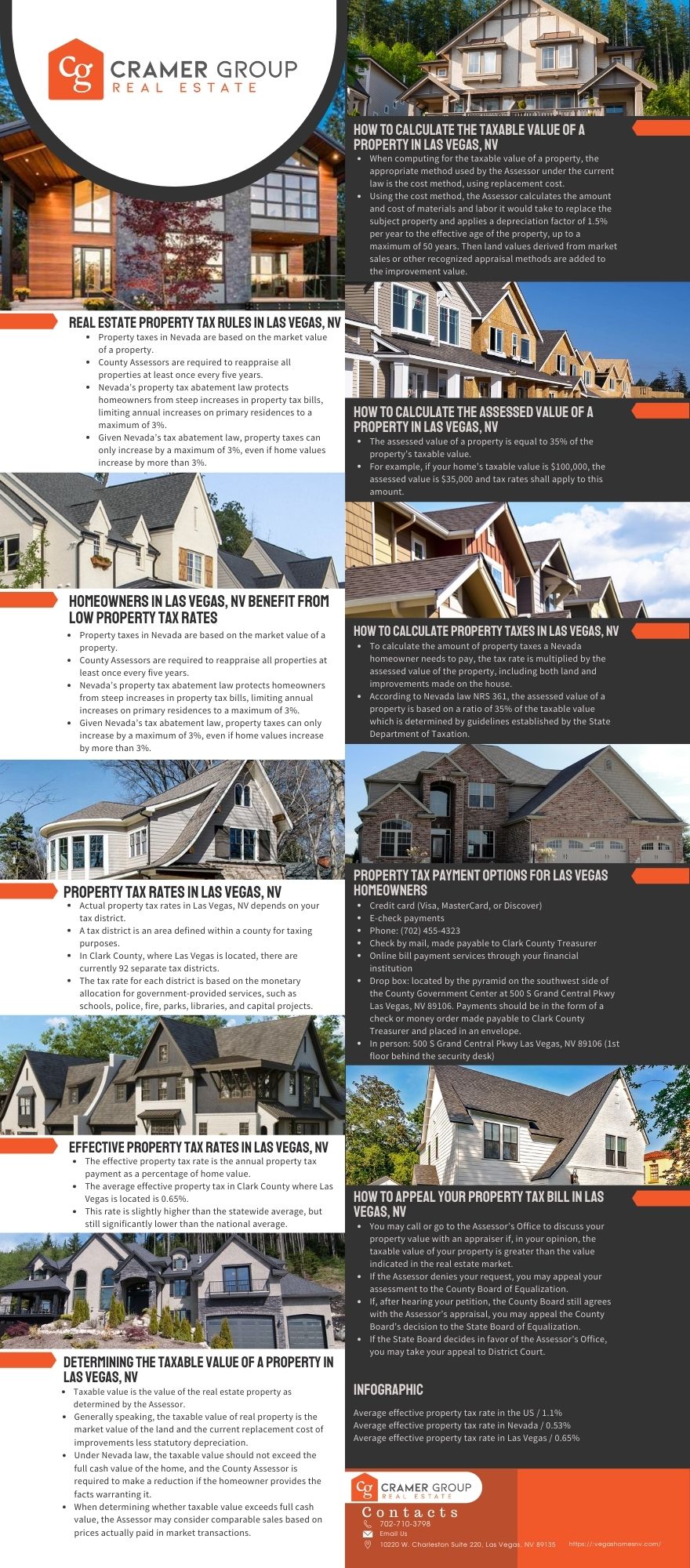

The Auditor-Controller Property Tax Division is responsible for the calculation and preparation of the secured unsecured unitary and supplemental property tax bills. Whether you are already a resident or just considering moving to Nevada to live or invest in real estate estimate local property tax rates and learn. Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues.

The states average effective property tax rate is just 053. Compared to the 107 national average that rate is quite low. NRS 3614723 provides a partial abatement of taxes.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Homeowners in Nevada are protected from steep increases in. So even though Nevada does not.

Learn all about Nevada real estate tax. Whether you are already a resident or just considering moving to Mesquite to live or invest in real estate estimate local property tax rates and learn. No estate tax or inheritance tax.

What state has no property tax. Next find the assessed value which is thirty-five percent of 6428000 or 2249800. Counties in Nevada collect an average of 084 of a propertys assesed fair.

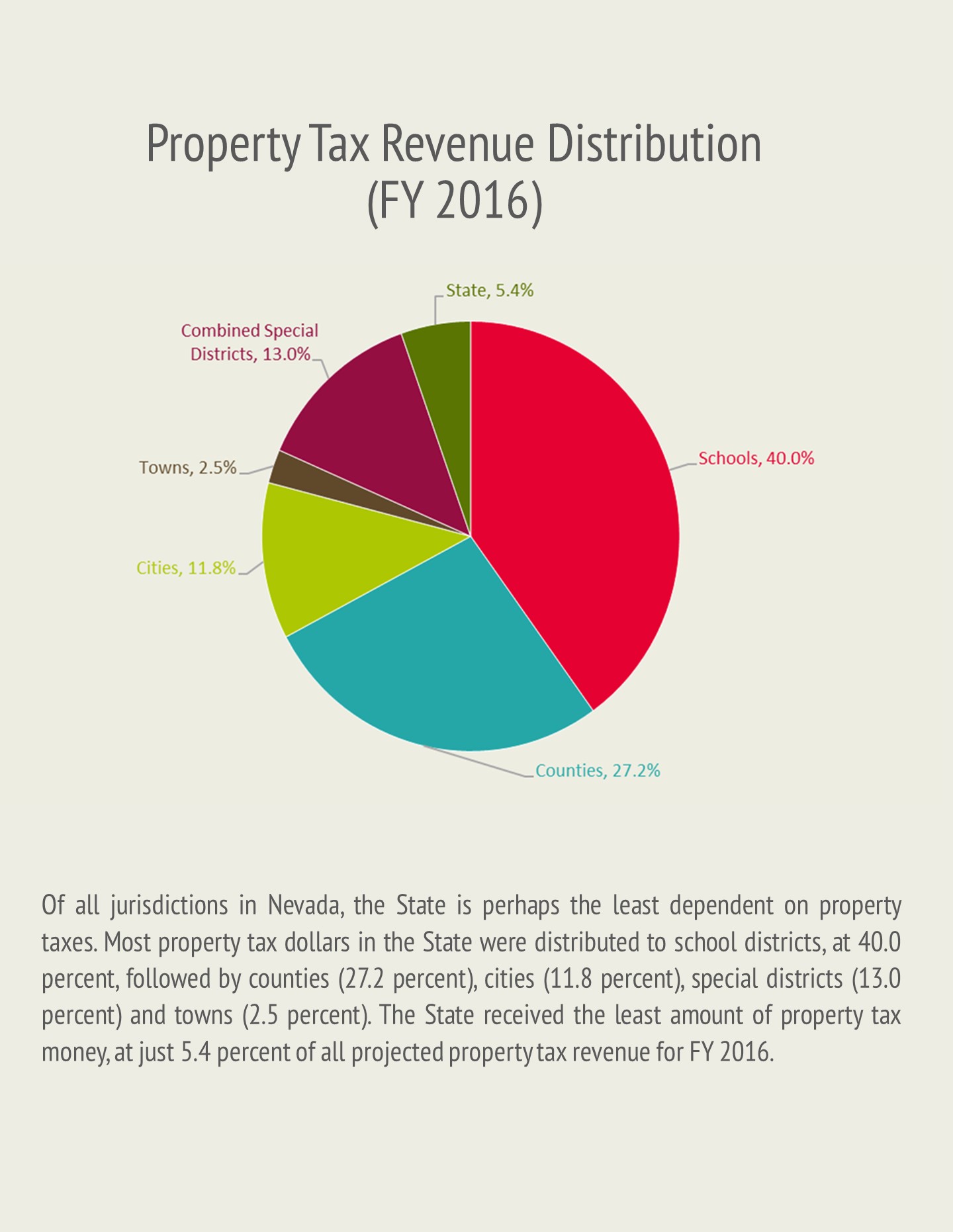

From Fisher Investments 40 years managing money and helping thousands of families. Property Tax Rates How Property Tax Dollars are Spent. For more information contact the.

Nevada has no state income tax. The property tax rates are proposed in April of each year based on the budgets prepared by the various local governments. Nevada also has low property tax rates which will usually be half of 1 to 1 of assessed value.

Learn all about Mesquite real estate tax. Rates include state county and city taxes. The median property tax in Nevada is 174900 per year based on a median home value of 20760000 and a median effective.

If real property is. Nevada property tax rate info by United Paramount Tax Group Compare lowest cheapest and highest NV Personal property taxes. The states average effective property tax rate is just 053.

As Percentage Of Income. Nevada has a 685 percent state sales tax rate a max local sales tax rate of 153 percent and an average combined state and local sales tax rate of 823 percent. Nevadas tax system ranks.

The top inheritance tax rate is 16 percent no exemption threshold New Mexico. Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement. The State of Nevada sales tax rate is 46 added to.

If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax Credit Nevada that was collected prior to January 1 2005. Our Rule of Thumb for Las Vegas sales tax is 875. Search Homes Our Team Our Agents Las Vegas Communities.

No estate tax or inheritance tax. Las Vegas Property Taxes - how to calculate property taxes in Nevada and how to learn more. FY 2020 to 2021 PDF FY 2019 to 2020 PDF FY 2018 to 2019 PDF FY 2017 to 2018 PDF FY 2016 to 2017 PDF.

Only the Federal Income Tax applies. Multiply the assessed value by the tax rate which is 32782 in Las Vegas City in. Please verify your mailing address is correct prior to requesting a bill.

Counties cities school districts special districts such as fire. Tax bills requested through the automated system are sent to the mailing address on record. Technically the Las Vegas sales tax rate is between 8375 and 875.

Nevada Property Tax Calculator Smartasset

City Of Reno Property Tax City Of Reno

How High Are Capital Gains Taxes In Your State Tax Foundation

Property Taxes In Nevada Guinn Center For Policy Priorities

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Nevada Vs California Taxes Explained Retirebetternow Com

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Property Taxes In Nevada Guinn Center For Policy Priorities

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Nevada Inheritance Laws What You Should Know

Taxes In Nevada U S Legal It Group

States With Highest And Lowest Sales Tax Rates

Property Taxes In Nevada Guinn Center For Policy Priorities

The States With The Highest Capital Gains Tax Rates The Motley Fool

Property Taxes In Nevada Guinn Center For Policy Priorities

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty